Credit Management

Credit Management

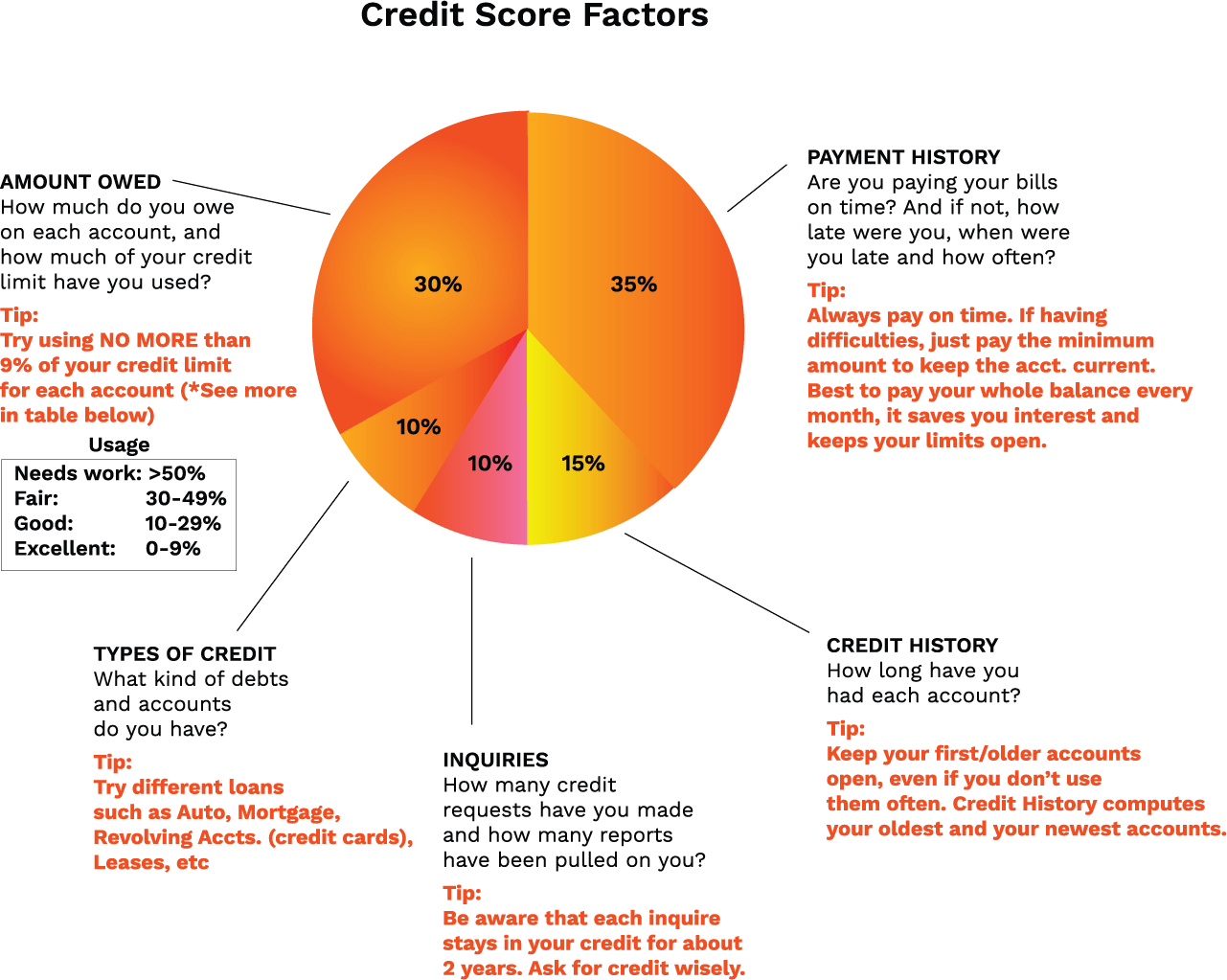

Let’s delve into the concept of credit and responsible spending. When lenders assess your credit worthiness or purchasing power, it’s important to maintain a positive standing. This involves consistently paying your bills on time and refraining from overspending, even if you have a generous credit line available. Lenders seek to gauge your financial responsibility when entrusting you with a loan. Picture this: you’ve got a $100,000 credit line. While it’s tempting to splurge, it’s actually wiser to stick to around 9% usage – say, roughly $9,000. By doing so and clearing your balance monthly, you’ll have lenders doing the hula in joy! By demonstrating restraint and paying off your balance promptly each month, lenders may even consider increasing your credit limit. Now, why do they offer you all that credit but advise restraint? It’s a bit of a head-scratcher, but hey, that’s just the way the trade winds blow in the financial world.

Credit Worthiness

When evaluating your creditworthiness, lenders typically consider several key factors:

Payment History: Lenders want to see if you have a history of making payments on time. Late payments or defaults can raise red flags.

Credit Utilization: This refers to the amount of credit you’re using compared to the total available credit. Keeping your credit utilization low demonstrates responsible borrowing behavior.

Credit History Length: A longer credit history generally reflects more experience managing credit, which can be viewed favorably by lenders.

Credit Mix: Lenders like to see a diverse mix of credit types, such as credit cards, loans, and mortgages. It shows you can manage various financial obligations.

New Credit Inquiries: Opening multiple new credit accounts within a short period may indicate financial instability, which could concern lenders.

Income and Employment Stability: Lenders assess your ability to repay debts based on your income and job stability. A steady income stream increases your creditworthiness.

Debt-to-Income Ratio: This compares your total monthly debt payments to your gross monthly income. A lower ratio suggests you have more disposable income to handle new debt obligations.

These factors collectively help lenders gauge the level of risk associated with extending credit to you. It’s essential to maintain a positive track record across these areas to enhance your creditworthiness.